Dr Kostas Kollydas and Professor Anne Green investigate the geography of flexible and remote work in the UK, drawing on trends from online job posting data.

Background

Working from home (WFH) and flexible (‘hybrid’) working patterns in the UK vary markedly across time, industries, and local areas. Previous studies report that homeworking was modest before the Covid‐19 pandemic (2.4% of individuals worked at home in 2010, rising to 3.4% by 2019) but surged to 43.1% in April 2020 (during the first lockdown) before declining to about 27% in late summer 2020. Professionals, managers, and those working in certain sectors, such as finance, IT, and law, show notably higher adoption of homeworking than many others. Construction, wholesale/retail, transportation, and health-related services generally report lower rates.

The literature indicates that job characteristics influence remote work uptake. Occupations that demand advanced skills, higher education, and offer higher earnings are more likely to support remote work. Moreover, the likelihood of never WFH is higher in more deprived areas. Additional examples of differentiating factors include worker characteristics (such as gender) and reliable digital infrastructure. These findings demonstrate that WFH patterns, although they evolved rapidly due to Covid-19, are structured by occupational, socioeconomic, and other determinants.

Before Covid-19, it was believed that homeworking was the result of certain developments like more self-employment, skilled jobs, and women in work rather than a true shift in work organisation. However, there is evidence that these factors explained only part of the rise in remote working between 1992 and 2015, implying that a deeper transition in where people work had already begun before the pandemic.

Notwithstanding this, the world of work in the UK has changed substantially since 2020 as a consequence of the COVID-19 shock. Analysis of Adzuna data[1] presented below shows significant fluctuations in overall job demand between 2019 and 2024 and a rise in new ways of working, especially in certain urban areas.

Trends in overall job demand in the UK (2019-2024)

In 2019, the total number of unique online job postings in the UK ranged between 3.4 and 4.5 million (see Figure 1 below). This dropped sharply in early 2020 (at the onset of the pandemic) to just 1.6 million in the second quarter (Q2) of 2020. This initial shock was followed by a strong recovery. By late 2021, total job demand in the UK peaked at over 5 million job postings. Since then, however, this figure has steadily decreased. By the end of 2024, the total number of job postings had fallen to around 2.2 million (a 57% decrease compared to Q4 2021). This picture likely reflects ongoing economic pressure over the last few years, which was initially triggered by high inflation and rising energy costs in 2022. As a result, employers across sectors have thought twice about recruiting.

Figure 1. Total number of unique online job postings in the UK (in millions), Q1 2019 – Q4 2024

Source: Adzuna Intelligence; authors’ own calculations.

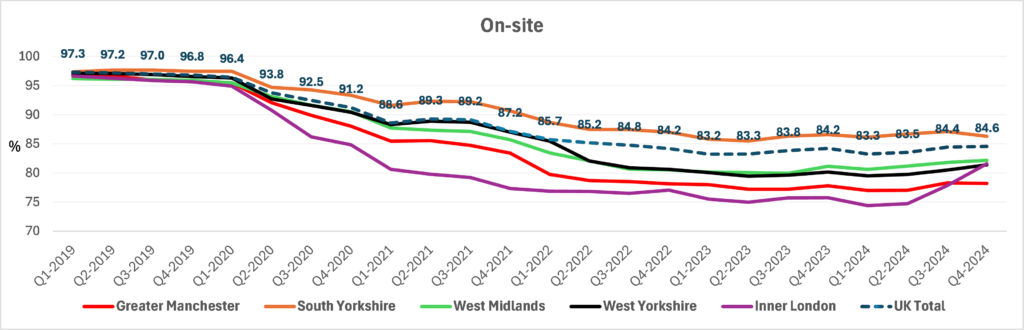

Changes in job demand by workplace model

Alongside these changes in overall demand, the nature of advertised jobs, which is reflected in the share of each of the three workplace models (“remote-only”, “flexible”, and “on-site”) in total demand, has also changed significantly (Figure 2). Before the pandemic, job postings associated with “remote-only” roles made up a very small share of all postings in the UK (2.5% in late 2019). During the strictest lockdown phases of the pandemic, there was a notable increase in this share. In early 2021, nearly 10% of all online job ads offered fully remote work. This share then fell as the economy reopened and people started returning to their workplaces on a more frequent basis but remained above pre-pandemic levels. By the end of 2024, remote-only jobs constituted 3.3% of total demand in the UK.

Geographical disparities in remote and flexible working

Looking at the spatial dimensions of these patterns, using the example of selected city-regions, it appears that some areas moved faster to non-traditional models of working than others (Figure 2). During the analysis period (2019-2024), Inner London saw the highest increase in remote-only roles, which rose from just over 3% in Q4 2019 to nearly 17% in early 2021. By 2024, this proportion had dropped to around 5% but remained well above the UK average (3.3%). Greater Manchester and the West Midlands followed a similar trend, although they demonstrated smaller peaks. On the other hand, South Yorkshire experienced slower changes. Its remote-only share peaked at 7.2% in Q1 2021 and declined to less than 3% at the end of 2024.

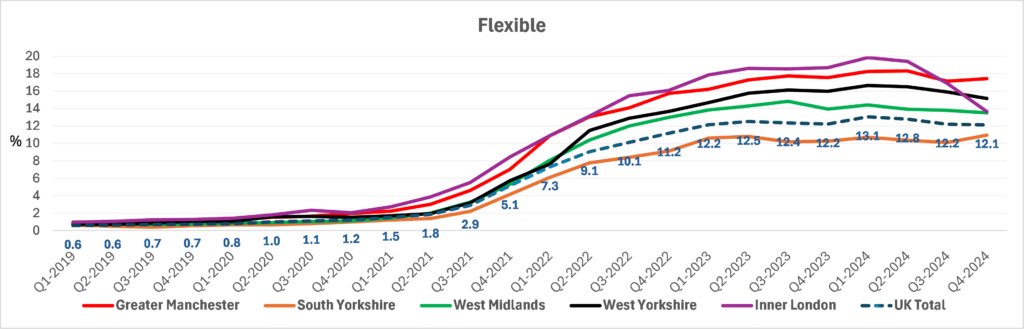

Demand for flexible (‘hybrid’) roles, where workers can combine remote work and physical presence at their workplaces, tells a rather different story. These jobs were almost invisible before the pandemic (less than 1% on average), and their share remained low until early 2021. From that point, flexible roles saw an impressive increase in job postings. By 2023, flexible jobs accounted for 12%-13% of all job postings in the UK and this level held through 2024. These jobs seem to reflect a more lasting change in how employers organise work and how they consider new attitudes and preferences of the labour force alongside business needs. Again, Inner London led the way. Hybrid roles there reached nearly 20% of postings in early 2024. Over the following year, however, this share dropped by 6 percentage points to 14% in Q4 2024. It remains to be seen whether this decline reflects a temporary change or a gradual return to more traditional, in-person workplace models. Greater Manchester and West Yorkshire reached peak levels between 17% and 18% in flexible roles. South Yorkshire had the lowest shares, which rose to approximately 11% in Q1 2024.

Figure 2. Share (%) of online job postings by workplace model (remote only, flexible, on-site) in total job demand over time across selected areas (Q1 2019 – Q4 2024)

Note: The figure shows selected NUTS2 areas that include large cities. Inner London refers to the combined areas of Inner London – East and Inner London – West. The values displayed in the graphs refer to the UK total (dashed blue lines). For each quarter, the shares within each area across the three workplace models (remote only, flexible, and on-site) sum to 100%. Source: Adzuna Intelligence; authors’ own calculations

A more detailed look at job demand patterns by Local Authority District (Q1 2025)

Figure 3 shows a more detailed geographical breakdown of the job demand in the first quarter of 2025 by Local Authority District area (see the Figure note for links to access to detailed data and higher-resolution maps).

Flexible working patterns are most common in large cities and economically diverse urban areas. For example, the City of London, Manchester, Leeds, and Glasgow all report flexible shares that are well above the UK average of 12%. Rural and coastal areas generally show much lower levels of hybrid work. In local areas like Fenland, Forest of Dean, and North Norfolk, hybrid working shares are below 3%. These local areas often have fewer jobs in finance, tech, or professional services. Instead, their local labour markets are more reliant on sectors such as agriculture, tourism, or manufacturing, which are more likely to require a physical presence.

It also appears that the geography of hybrid work mirrors patterns of both economic structure and connectivity. For instance, commuter zones near London, such as Woking and Wokingham, see above-average flexible rates. This likely reflects access to professional jobs with flexibility built in. In contrast, industrial towns in Ashfield or Bolsover show low hybrid rates (around 5%-6%).

Figure 3. Share (%) of online job postings by workplace model (remote only, flexible, on-site) in total job demand by Local Authority District area (05 January – 16 March 2025)

Note: Darker shading indicates higher shares. High-resolution maps showing the share (%) of each workplace model in total job demand by Local Authority District area are available at the following links: remote only, flexible (hybrid), on-site. Source: Adzuna Intelligence; authors’ own calculations.

Conclusion: A lasting transition towards flexible work?

The increase in remote-only work measured using online job posting data during the Covid-19 pandemic was sharp but short-lived. Flexible roles, in contrast, have grown steadily and now appear to be part of a “new normal”. It seems that flexible working is here to stay, especially in some of the UK’s major cities. Large urban centres with more knowledge-based jobs have been quicker to adopt remote and hybrid models. On the other hand, in places where jobs rely more on physical presence, such as manufacturing or logistics, change has been slower.

Part of the aforementioned variation should be linked to the industrial and occupational structure in each geographical area. Adams-Prassl et al. (2022) used 2019-2020 survey data from over 25,000 individuals in the US and UK to measure how much of their jobs can be done from home. They found considerable variation not only across but also within occupations and industries. For example, the average share of tasks that can be done from home ranged from 14% in “food preparation and serving” to 68% in “computer and mathematical” occupations. However, the same study also highlighted that occupation and industry alone explain only about one-quarter of the variation. Workers in the same occupation often report very different abilities to work from home. For instance, in occupations related to “office and administrative support”, many respondents reported that they were able to do either very few or nearly all tasks from home, suggesting a polarised or “bi-modal” distribution. In contrast, “architecture and engineering” shows a normal distribution around the mean. In addition, temporary and variable-hour workers report significantly lower shares of homeworking. Gender gaps persist but are partly explained by occupational sorting.

One thing that seems clear is that flexible work is still evolving. What it becomes in the long run will depend on how employers, workers, and policymakers adapt to changing needs and contexts.

Footnote

[1] Adzuna is an online job search engine that compiles data from an extensive number of sources (such as employer websites, job boards, and recruitment software providers). Throughout this article, Adzuna data refers to unique (deduplicated) online job postings.

This blog was written by Dr Kostas Kollydas, Research Fellow, City-REDI and Anne Green, Professor of Regional Economic Development and Co-Director of City-REDI, University of Birmingham.

Disclaimer:

The views expressed in this analysis post are those of the author and not necessarily those of City-REDI or the University of Birmingham.